Unknown Facts About Amur Capital Management Corporation

Unknown Facts About Amur Capital Management Corporation

Blog Article

The Ultimate Guide To Amur Capital Management Corporation

Table of ContentsAmur Capital Management Corporation - QuestionsEverything about Amur Capital Management CorporationWhat Does Amur Capital Management Corporation Do?Some Known Questions About Amur Capital Management Corporation.All About Amur Capital Management CorporationWhat Does Amur Capital Management Corporation Do?

This makes genuine estate a profitable lasting investment. Actual estate investing is not the only method to spend.

The smart Trick of Amur Capital Management Corporation That Nobody is Talking About

Considering that 1945, the ordinary big stock has returned close to 10 percent a year. That said, supplies might just as easily depreciate.

That stated, real estate is the polar contrary relating to certain facets. Web earnings in actual estate are reflective of your own activities.

Stocks and bonds, while often abided together, are basically different from one an additional. Unlike stocks, bonds are not agent of a stake in a company.

Some Ideas on Amur Capital Management Corporation You Need To Know

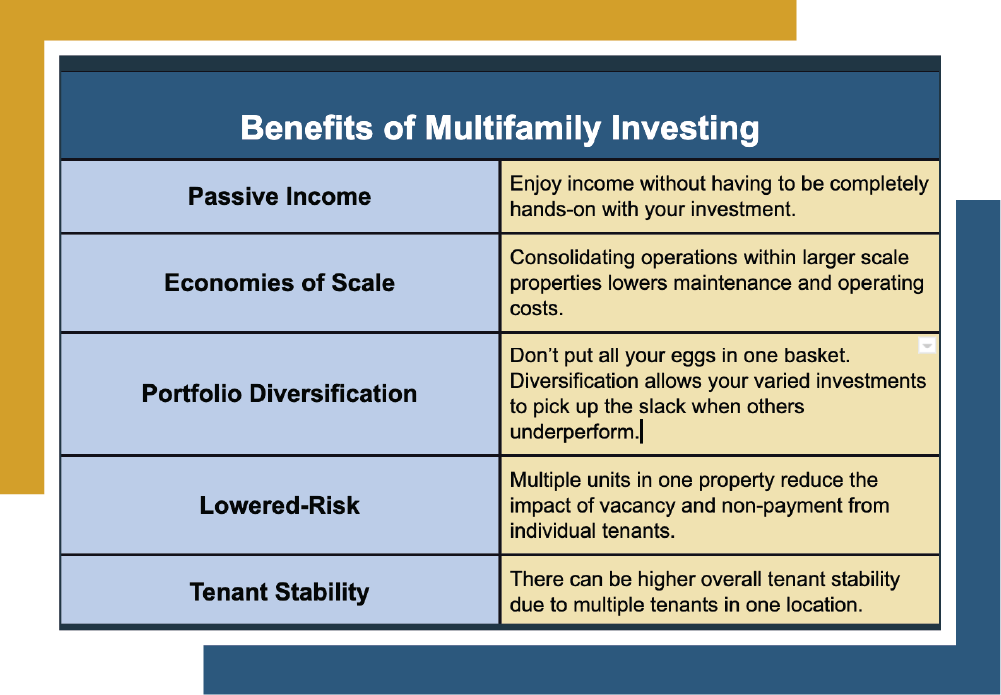

The actual advantage property holds over bonds is the moment structure for holding the investments and the price of return during that time. Bonds pay a set interest rate over the life of the financial investment, thus buying power with that said interest drops with inflation with time (alternative investment). Rental residential or commercial property, on the other hand, can generate higher rental fees in durations of higher inflation

It is as straightforward as that. There will certainly always be a demand for the rare-earth element, as "Half of the globe's population relies on gold," according to Chris Hyzy, chief investment police officer at U.S. Trust, the exclusive riches management arm of Financial institution of America in New York City. According to the World Gold Council, need softened you could check here last year.

The Basic Principles Of Amur Capital Management Corporation

As a result, gold costs ought to come back down-to-earth. This should draw in innovators wanting to utilize on the ground level. Identified as a reasonably safe commodity, gold has established itself as an automobile to raise financial investment returns. Some do not also take into consideration gold to be an investment at all, rather a hedge versus rising cost of living.

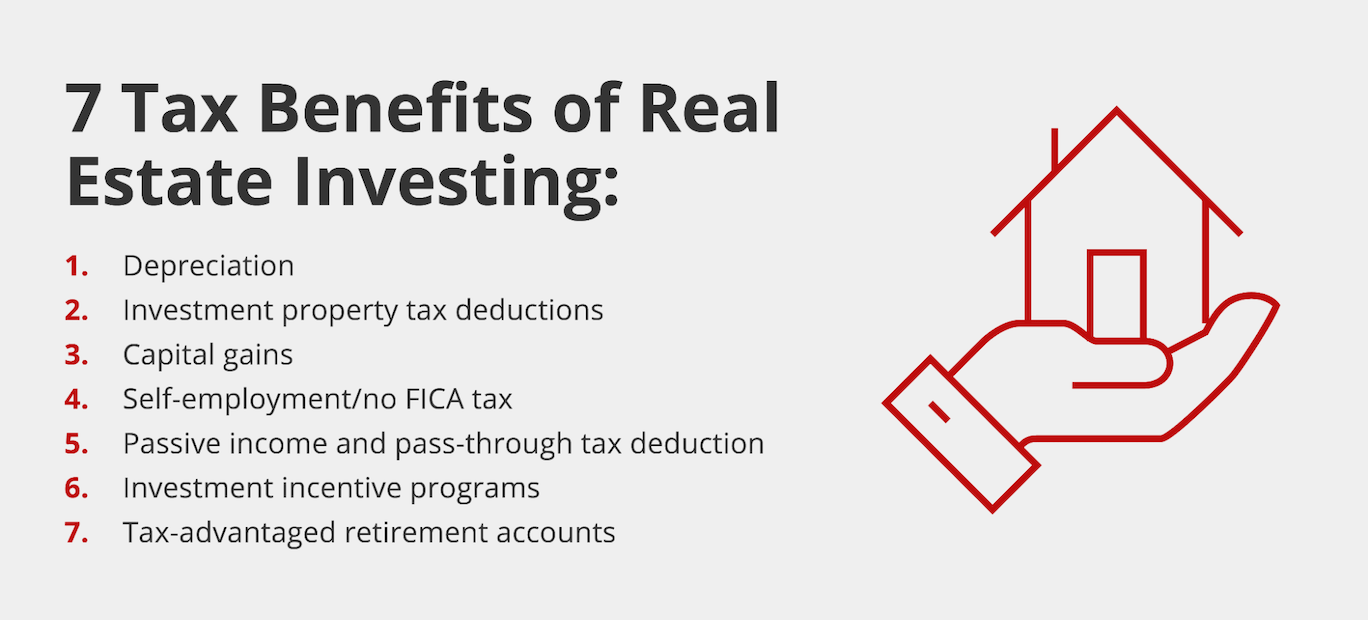

Of course, as safe as gold may be thought about, it still falls short to continue to be as attractive as realty. Here are a few reasons investors choose property over gold: Unlike genuine estate, there is no financing and, consequently, no area to leverage for growth. Unlike realty, gold suggests no tax advantages.

Amur Capital Management Corporation Fundamentals Explained

When the CD grows, you can collect the initial investment, along with some passion. Real estate, on the various other hand, can appreciate.

It is just one of the easiest methods to expand any profile. A common fund's performance is always gauged in regards to overall return, or the amount of the adjustment in a fund's net property worth (NAV), its dividends, and its funding gains circulations over an offered period of time. Much like supplies, you have little control over the performance of your possessions.

As a matter of fact, putting cash right into a common fund is essentially handing one's investment choices over to a specialist money manager. While you can choose your investments, you have little state over exactly how they execute. The three most common methods to spend in property are as adheres to: Buy And Hold Rehab Wholesale With the most awful component of the recession behind us, markets have gone through historical recognition prices in the last 3 years.

The smart Trick of Amur Capital Management Corporation That Nobody is Talking About

Acquiring low does not indicate what it used to, and investors have actually identified that the landscape is altering. The spreads that dealers and rehabbers have become familiar with are beginning to create memories of 2006 when values were traditionally high (best investments in canada). Certainly, there are still numerous opportunities to be had in the globe of flipping property, however a brand-new departure strategy has actually arised as king: rental homes

Otherwise recognized as buy and hold buildings, these homes feed off today's admiration rates and take advantage of the truth that homes are more costly than they were simply a couple of short years earlier. The concept of a buy and hold departure strategy is basic: Financiers will certainly want to raise their bottom line by leasing the home out and accumulating regular monthly cash flow or simply holding the property until it can be offered at a later day for a profit, obviously.

Report this page